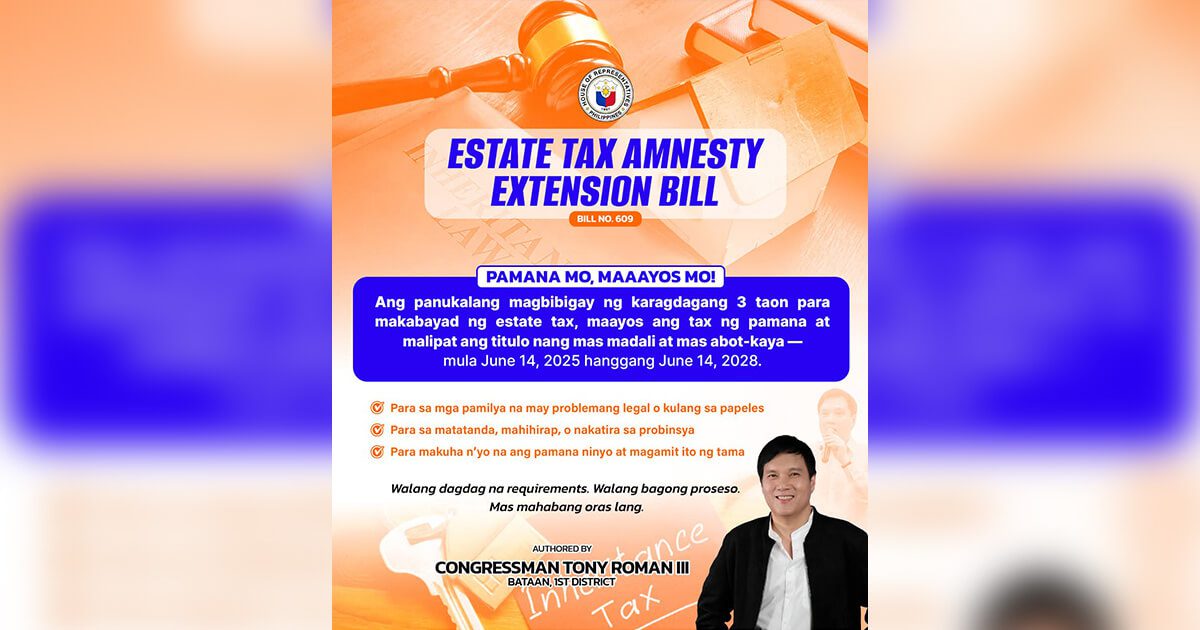

Bataan 1st District Representative Atty. Tony Roman has filed a measure seeking to extend the government’s Estate Tax Amnesty program for another three years, giving families more time to settle unpaid estate taxes and transfer titles of inherited properties.

Under Republic Act 11956, which amended the original Estate Tax Amnesty Law (RA 11213), heirs of those who died on or before May 31, 2022 were allowed to pay a flat 6 percent estate tax rate without surcharges, penalties, or interest. However, the program is set to expire on June 14, 2025, leaving many properties in legal limbo because taxes have yet to be paid.

Roman’s proposed extension would move the deadline to June 14, 2028. “Mas maraming oras para makumpleto ang mga papeles, walang bagong proseso at walang dagdag na bayarin,” Roman said in a social media post as he explained that the measure would allow heirs to “fix the titles of land and other properties left by loved ones” that cannot be sold, repaired, or fully used because of unpaid estate taxes.

Estate tax liabilities have long been cited as a barrier to land transfer in the Philippines. Without amnesty, heirs must pay full estate tax plus penalties before they can register property under their name. Through the amnesty, they only need to pay the reduced tax and submit a simplified return, paving the way for heirs to finally secure titles for ancestral lands and other inherited properties.

Roman emphasized that the extension will unlock neglected properties and enable families to utilize and develop their inheritance. The proposed measure forms part of his advocacy to make public service programs more accessible, with the goal of easing the burden on ordinary Filipinos in complying with tax requirements.

The post Roman pushes for three-year extension of Estate Tax Amnesty appeared first on 1Bataan.